The budget battles Is discussion possible?

#661

Posted 2011-August-17, 07:58

This seems to me to be more than just a lack of savvy. More like letting the number hang out there as a point of advocacy and then, when it doesn't work out, saying "Well golly gee,I wasn't the one who said that."

At any rate, neither for the first nor last time, Obama ends up looking not so good. Attributing this to Republicans being mean just isn't enough.

#662

Posted 2011-August-17, 08:13

PassedOut, on 2011-August-17, 07:44, said:

Perhaps because there are so many of them (on both sides of the aisle) that it's hard to keep up.

As for tv, screw it. You aren't missing anything. -- Ken Berg

I have come to realise it is futile to expect or hope a regular club game will be run in accordance with the laws. -- Jillybean

#663

Posted 2011-August-17, 08:47

BAIL'EM OUT!!! ???? Hell, back in 1990, the Government seized the Mustang Ranch brothel in Nevada for tax evasion and, as required by law, tried to run it. They failed and it closed. Now, we are trusting the economy of our country, our banking system, our auto industry, our home utilities, and possibly our health plans to the same nit-wits who couldn't make money running a whore house and selling whiskey?!"

"What the Hell are we thinking?"

#664

Posted 2011-August-17, 08:56

kenberg, on 2011-August-17, 07:58, said:

That's right.

As president-elect, Obama (and everyone else) knew that he faced a serious economic crisis that he'd have to deal with as soon as he was inaugurated. His economic advisors worked long hours to prepare for inauguration day, and the Romer/Bernstein report was a product of that preparation. The advisors did not have the full resources of the government, but did have the current CBO projections to work with. The report was released a couple of weeks before Obama's inauguration.

By the time Obama was inaugurated, the CBO unemployment projections had continued to rise, so the projections on the Romer/Bernstein report were already known to be too low. At that time no one knew how bad the situation actually was, so neither Obama nor his advisors ever gave a specific number. If they had, we can be sure that Obama's opponents would be using that number rather than pointing to the Romer/Bernstein report.

Why the Obama people never challenged the false claims by Eric Cantor, George Will, and many others simply befuddles me. It's like failing Politics 101. All of the politicians in Washington and all of the news media people who cover Washington know that the Obama administration never promised to hold unemployment to 8.5%.

Maybe Obama's people expected the news people to do the challenging. Maybe they didn't fight back because they didn't have an accurate number to give. Maybe they thought that a very pessimistic number would contribute to depressing the economy. Maybe they thought the importance of the numbers would fade in the light of other events. Whatever the reason, it was a serious error and -- you are certainly right -- does not burnish Obama's credentials as a politician.

The infliction of cruelty with a good conscience is a delight to moralists — that is why they invented hell. — Bertrand Russell

#665

Posted 2011-August-17, 09:08

WellSpyder, on 2011-August-17, 02:59, said:

SO the relevant papers are based on the idea that an economy has some foresight about what the government will do, so this was started by Romer & Romer who used narratives to seperate tax changes into groups based on motivations, and looks at them separately. This showed that the spending multipliers for tax changes are different depending on the motivation. You can find it here. You can skip to the graphs at the end to get a general idea of her conclusions. Her analysis has been replicated by others, although whether you agree on the motivation to her paper is more interesting. Valarie Ramay essentially repeated the Romer analysis for spending, and compared it to standard analysis, and suggests that the conventional multipliers are too high. You can find it here.

#666

Posted 2011-August-17, 09:18

Romer said, “The basic idea that if you increase government spending or you cut people’s taxes that stimulates the economy and lowers the unemployment rate, is a very widely accepted idea. It’s in every economics textbook, that’s what we teach our undergraduates, and I certainly try to teach them the truth.

“It is a very known and accepted idea and fact and the empirical evidence is definitely there, and people just want to say the sky is green.”

#667

Posted 2011-August-17, 09:36

awm, on 2011-August-16, 20:56, said:

If you want some more authoritative sources, here's Nobel prize winning economist Paul Krugman arguing that the stimulus should include more spending and less tax cuts. And here are some numbers by Mark Zandi, economist for Moody's.

Of course, there may also be articles supporting Phil's view that tax cuts are better stimulus than government spending. But his suggestion that this is somehow a "settled matter" amongst economists is obviously untrue.

So i could criticise all thse links. Firstly the Wikipedia article provides a list of different multipliers as calculated by diferent people, including, say, barro, who thinks they are negative. You have just quoted the Zandi numbers that are also the numbers in Zandi's paper and the same numbers in the Econbrowser link. These numbers are all "one year multipliers", if you look at romer and romer, they are the 3 year multipliers. If you read off the graphs you would find that she agrees with those numbers roughly. However, tax rises are more "sticky" and the largest benefit comes roughly two years after they are instituted, whereas spending comes all at once, and its effect vanishes after it stops. Tax changes continue to give benefit even after the tax is changed back as people to not quickly adjust consumption based on marginal changes in cost. I.e. A one year tax cut doesnt really do anything, as the market barely adjusts before it is back in place. It is however, a policy question on whether you think the USA's troubles are short term, medium term, or longterm. If short term, as in a manufacturing led recession, then clearly spending is better. If you think the USA is going to need 5 years to get back on track (I am in this camp) due to debt, then tax decreases are likely better. Having said that, I think the long term effects of debt are going to be bad whenever you choose to face them. Any efforts to stimulate demand via debt will only make facing the problem harder when you do change tax. Especially considering the demographics of the US.

Finally, krugmans democratic partisanship is so well known that it has its own wikipedia entry. He is a well credentialled economist certainly, but so is Gregory Mankiw, and they seem to disagree on almost everything. (Well, thats not really true, but they often accuse each other of deliberately saying things they know to be untrue in order to score political points, e.g., the exchange on "the man who can't be taxed"). Infact, Mankiw has long been the camp of thinking tax multipliers are undervalued, and has studied it a lot under the guise of the question "how much of a tax drop will the government recoup".

I do read Krugman's blog, is stuff about liquidity traps is pretty compelling, but he is a keynesian who seems to think that long run issues do not matter that much. His oft repeated argument that borrowing (even more) now to prop up spending will not cost because interest rates are low now is pretty naieve. For one thing, interest rates are mostly low now because people are worried about the economy/stocks, not because they beleive that the US is in a healthy spot. When the money goes back to equities the bonds market will reflect expectations better. Secondly, debt overhang is a well known problem in economics, krugman favours spending now, and having more inflation later (in fact, he thigns the US should be aiming for 4-6% inflation right now). This would probably work, and would be part of my preferred solution, but will crush pensioners and savers. Its not clear that that is a politically acceptable outcome. Taking the first part of the medicine when there is no prospect of ever taking the second part seems worse than useless.

#668

Posted 2011-August-17, 09:46

y66, on 2011-August-17, 06:27, said:

As Obama was putting his plan together, the Congressional Budget Office was reporting that U.S. economic output would average 6.8 percent below it's potential for the next 2 years, or $2.1 trillion in lost production (per Krugman).

A hemorrhaging patient loses 2.1 trillion units of blood. You restore 775 billion units.

The patient is still looking a little peaked.

You conclude what exactly?

I have never appreciated this argument. I mean, its based on keynes, but keynes also wrote about recessions as creative destruction, and if you believe that then propping up the economy by buying whatever they are making robs the economy of the chance to change direction. For example, a lot of the lost production is found in the housing market, where the us currently has a glut. The only way to improve the production gap in the housing market is for the government to get the construction companies to make houses, but if no-one needs houses that is only making the glut worse, the real reason for the production gap is that we built too many houses already. * The same might apply to designer clothes etc.

Secondly, if you think that deficit spending can prop up demand, then that must be what has already happened in the racking up of household debt. If you beleive that then you must think (like I do) that demand prior to the recession was un-sustainably high, driven by easy credit, and a painful adjustment is needed when demand falls and debt is paid off. If the government continues sustaining demand at that unsustainable level that is only putting off a painful contraction in demand until another day. When there is pain to be had best to get it over with quickly.

*Yes, I know most construction companies can make other things than houses. I was looking for an example and this seemed to make my point. Obviously, they could build roads and stuff and that would be a good think in the US. In the uk most of our transport infrastructure is in pretty good nick, so that would not be possible here.

#669

Posted 2011-August-17, 09:59

phil_20686, on 2011-August-17, 09:36, said:

Finally, krugmans democratic partisanship is so well known that it has its own wikipedia entry.

I couldn't care less if Krugman is a partisan.

What I care about is the reliability of his nostrums.

On this front, I'll let that well known flaming liberal David Frim make my case for me

http://www.frumforum...r-enemies-right

#670

Posted 2011-August-17, 10:10

PassedOut, on 2011-August-17, 08:56, said:

And Bush never said "Mission Accomplished". He just flew in with media coverage to a ship with banners saying "Mission Accomplished". Somehow people still held him responsible for the claim.

I am not befuddled at all. The number was getting play, and he liked that fact until the numbers did not turn out that way.

Obama did not fail Politics 101. The explanation has to lie elsewhere.

#671

Posted 2011-August-17, 10:16

phil_20686, on 2011-August-17, 09:46, said:

One of the problems of the internet is that it can be hard to detect sarcasm, so I can't tell whether you really mean this or not. But in any case, I beg to differ! Although one can argue about whether it is possible to fund improvements at the moment, I think there is significant evidence of shortcomings in the UK's transport infrastructure, ranging from heavy congestion at times on roads and rail and at airports to a huge increase in potholes in the roads.

(Please don't think I disagree with all your arguments, though. I agree that there is no point in supporting jobs producing things that nobody wants. And I don't think increasing public spending is the answer to current economic woes. But I'm pretty sceptical of the case for tax cuts, too!)

#672

Posted 2011-August-17, 10:18

kenberg, on 2011-August-17, 10:10, said:

Not likely, since the only way the number was used -- even in the first half of 2009 -- was to bash Obama. But no doubt folks can honestly differ on whether publishing a working report with heavily qualified numerical projections is like giving a speech standing before a huge banner that says "Mission Accomplished."

The infliction of cruelty with a good conscience is a delight to moralists — that is why they invented hell. — Bertrand Russell

#673

Posted 2011-August-17, 10:20

hrothgar, on 2011-August-17, 09:59, said:

What I care about is the reliability of his nostrums.

On this front, I'll let that well known flaming liberal David Frim make my case for me

http://www.frumforum...r-enemies-right

I read that already, and on teh one hand I do not disagree. I suspected a fall in demand. The difference is whether you thought demand was "on trend" prior to the crisis. Time to pull out a favourite chart:

you can see that in the the 7-8 years from 2000 to 2008 the US ran a budget deficit of about 3% GDP, all of which is in essence borrowed prosperity from the future. This means that compounding it, the GDP as measured, and the GDP excluding "borrowed prosperity" included, must have differed by about 10% come the crisis. Ideally One would like to repeat this analysis with consumer debt figures. Whenever you choose to balance the budget, that is the level of "demand correction" that one is probably expecting.

Data on consumer debt is found here

the key data for me is

Quote

Even more than government debt, consumer debt is borrowing against future proseperity. People have started to try to control this, and the loss in consumer demand is a lot. That number represents some 15% of US GDP, and while I have no data on what it was, I suspect it was mostly racked up recently (i.e in the last decade). All this is demand that is lost and most importantly it is not coming back. Krugman is suggesting propping up demand at a level that I do not beleive it will ever be returned to. The output gap here has become structural, rather than cyclical, and thus Government spending can at most soften the blow, and at worst saves up a worse problem for a rainy day. Moreover, since trend GDP will be structurally lower, so will trend government revenue, and that makes the deficit projections even worse.

#674

Posted 2011-August-17, 10:25

WellSpyder, on 2011-August-17, 10:16, said:

(Please don't think I disagree with all your arguments, though. I agree that there is no point in supporting jobs producing things that nobody wants. And I don't think increasing public spending is the answer to current economic woes. But I'm pretty sceptical of the case for tax cuts, too!)

COngestion is not necessarily a problem of infrastructure. The railways are terrible, but the roads are in a much better state than a decade ago prior to labour going on a drive about road maintenence. Particularly in Scotland. Even the railways are in a better state than they were at the end of British Rail. Even though their privatisation was an abject fail.

(I don't think tax cuts are teh answer either, I just think they would be better than deficit spending. I fundamentally think there is no answer to a change in structural levels of demand, other than getting on with life at a slightly lower standard of living)

EDIT: incidentally, I think that the number one indicator of a poor transport infrastructure is inequality of house prices. The better the transport infrastructure, the easier it is to live "close" to your work, and the smaller the premium on living close to the city centers. A thought experiment involving a star trek type transporter should convince you that transport is the prime driver of the location bonus. Thus, IMO, good government policy would be to build the first high speed rail link from london to, say, Newcastle, with the aim of trying to bring poorer/cheaper areas into the london orbit, and hence persuading industry and people to move to the north.

#675

Posted 2011-August-17, 16:45

#676

Posted 2011-August-17, 17:01

phil_20686, on 2011-August-17, 10:20, said:

you can see that in the the 7-8 years from 2000 to 2008 the US ran a budget deficit of about 3% GDP, all of which is in essence borrowed prosperity from the future. This means that compounding it, the GDP as measured, and the GDP excluding "borrowed prosperity" included, must have differed by about 10% come the crisis. Ideally One would like to repeat this analysis with consumer debt figures. Whenever you choose to balance the budget, that is the level of "demand correction" that one is probably expecting.

Data on consumer debt is found here

the key data for me is

Even more than government debt, consumer debt is borrowing against future proseperity. People have started to try to control this, and the loss in consumer demand is a lot. That number represents some 15% of US GDP, and while I have no data on what it was, I suspect it was mostly racked up recently (i.e in the last decade). All this is demand that is lost and most importantly it is not coming back. Krugman is suggesting propping up demand at a level that I do not beleive it will ever be returned to. The output gap here has become structural, rather than cyclical, and thus Government spending can at most soften the blow, and at worst saves up a worse problem for a rainy day. Moreover, since trend GDP will be structurally lower, so will trend government revenue, and that makes the deficit projections even worse.

Phil,

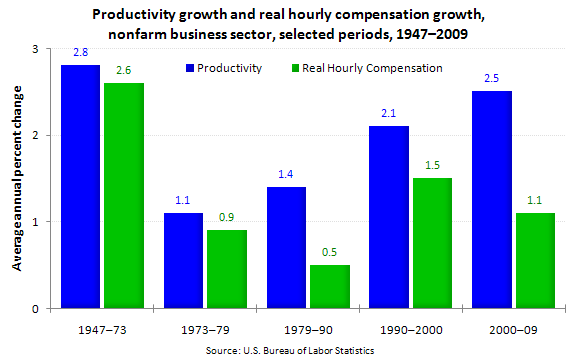

What these charts really do is to show magnificentally the affect of the wage-productivity gap on debt and GDP.

Healthy economies have a steady (over time) relationship between wages and productivity. As productivity increases, wages rise. This keeps demand up.

Beginning with the 1980s, U.S. wages began to lag productivity. To keep up demand, debt was used to plug the gap. Eventually, a debt peak was reached and then the collapse occured.

The long range solution is to increase wages and reduce debt. However, in the short range, it may be necessary to increase government stimulus (debt) in order to break out of the negative feedback loop we are in.

#677

Posted 2011-August-17, 19:19

Winstonm, on 2011-August-17, 17:01, said:

What these charts really do is to show magnificentally the affect of the wage-productivity gap on debt and GDP.

Healthy economies have a steady (over time) relationship between wages and productivity. As productivity increases, wages rise. This keeps demand up.

Beginning with the 1980s, U.S. wages began to lag productivity. To keep up demand, debt was used to plug the gap. Eventually, a debt peak was reached and then the collapse occured.

The long range solution is to increase wages and reduce debt. However, in the short range, it may be necessary to increase government stimulus (debt) in order to break out of the negative feedback loop we are in.

In the US your demand is already higher than your wages. Hence private debt. Also, a lot of your demand is satisfied by imports rather than domestic production, so even stimulating demand might do more for China than the US (an exaggeration). Finally, there are plenty of countries that run high productivity low consumption models, like Germany.

Secondly, it is not at all clear that US wages have lagged productivity. One classic error is too look at wages while forgetting about the ever increasing share paid by companies in pension and medical insurance. According to Feldstein, wages now make up only 80% of total compensation down from 90% in 1970. Felstein thinks that productivity and wages have a correlation "not significantly different from one" since 1970. A summary of his analysis is here.

Government spending is only the correct medicine to prop up demand to its trend line. A good idea in short sharp recessions. However, if the new level of structural demand is less than pre-crisis levels, you cannot avoid a contraction in demand in the medium term, and putting it off does not gain anything as it is impossible ever to wean the economy of deficit spending without eventually suffering the contraction in demand.

#678

Posted 2011-August-17, 20:02

Quote

Phil,

This sounds to me very much like the same type of justification for an ideological belief that

I hear from varied apologists when I point out a paradox of the religion. Are you certain you are searching for accuracy in your position and not allowing confirmation bias to cause you to search out sources that support your beliefs?

It seems other sources do not agree that wage-productivity gap has not changed. From the U.S. Bureau of Labor Statistics:

Quote

Real hourly compensation growth failed to keep pace with accelerating productivity growth over the past three decades, and the gap between productivity growth and compensation growth widened

#679

Posted 2011-August-17, 20:21

mike777, on 2011-August-17, 09:18, said:

Romer said, “The basic idea that if you increase government spending or you cut people’s taxes that stimulates the economy and lowers the unemployment rate, is a very widely accepted idea. It’s in every economics textbook, that’s what we teach our undergraduates, and I certainly try to teach them the truth.

“It is a very known and accepted idea and fact and the empirical evidence is definitely there, and people just want to say the sky is green.”

Just to make sure we are being "fair and balanced", I thought it a good idea to post the whole of Romer's comments. From the Bill Maher t.v. show:

Quote

Romer said, "The basic idea that if you increase government spending or you cut people's taxes that stimulates the economy and lowers the unemployment rate, is a very widely accepted idea. It's in every economics textbook, that's what we teach our undergraduates, and I certainly try to teach them the truth.

"It is a very known and accepted idea and fact and the empirical evidence is definitely there, and people just want to say the sky is green."

Obviously, what she meant that is taught in every economics textbook is Keynesian economics, and it is the people who try to oppose Keynesianism who "say the sky is green."

Furthermore, Keynes was not talking about income taxes but specifically payroll taxes, which he thought should be lowered in a downturn:

Quote

expenditure as compared with saving than a reduction in income tax would, and are free from the objection to a reduction in income tax that the wealthier classes would benefit disproportionately. At the same time, the reduction to employers, operating as a mitigation of the costs of production, will come in particularly helpfull in bad times.

#680

Posted 2011-August-18, 06:04

Winstonm, on 2011-August-17, 20:02, said:

This sounds to me very much like the same type of justification for an ideological belief that

I hear from varied apologists when I point out a paradox of the religion. Are you certain you are searching for accuracy in your position and not allowing confirmation bias to cause you to search out sources that support your beliefs?

Did you read Feldstein's note that I linked to? It is precisely these statistics that he disagrees with. Also, it is not clear what is included in "real hourly compensation" without a key-please provide a link. I have tracked down the link, as pointed "real compensation" seems to just be inflation adjusted compensation. Different people use the term to mean different things. Some people seem to include all benefits, some people want to include taxes whose incidence falls on employees, like the payroll tax, even if it is supposedly paid for by the companies. (The rational being that government provides benefits to workers so extra tax paid by the companies is a part of a workers total compensation). Some seem to think the BLS hourly wage data is restricted to those occupations paid by the hour. It definitely includes medical benefits, but not necessarily pension benefits. None of my usual sources seem very sure on this point.

However, some general criticisms of your link might go like this

(1) It is not clear in isolated cases that productivity should lead to a wage increase. The classic example is farms, where increased profits have put farms under increasing pressure due to falling prices, i.e. you now need a bigger farm to support a living wage than you did previously.

(2) On a national scale, the argument goes, that productivity should be linked globably to wage increases as increased productivity leads to a fall in prices. I.e. an increase in the purchasing power of a wage.

(3) As the world becomes more globalised what you consider as "global" and "local" can change.

However, I don't beleive that has much to do with the graph. For one thing, the gap, such as it is, up to 2000 has been entirely driven by differences between the retail price index and the consumer price index. If inflation rises faster for consumers it appears as a productivity gap. This explains all of the `gap' up to 2000, whereas prior to 1970 these tracked each other. Following that there has been a decline in "labour share", i.e. the cost of labour as a % of total costs. Productivity does not have to go into wages, if there is competition for resources then it can go into the hands of commoditites companies. If there is competition for capital it will go to bankers via higher interest rates. This appears to be what has happened. The commodities boom has been very expensive for the manufacturing sector, most of the productivity has gone into buying the raw materials it needs at ever higher prices. When commodities fall and labor share increases, you can expect a sharp rise in wages. This is a usual economic phenomenon, where whoever holds the rarest resource gets the profits. Materiel share is up 7% since 2000, which has nearly all come out of labour share, with a small increase in capital share (interest on debt that kind of thing).

All of this is clearly stated in the BLS report that this graph came from. You can find it here. Key exhibits are figures 6, 9 and 11.

In summary:

(1)there was no productivity gap prior to 2000.

(2) Since 2000 the gap is virtually entirely due to rising commodity prices. It is probably temporary as prices fall will probably fall.

(3) [b]There is no conspiracy[\b] to defraud the average worker and enrich the rich. Just Economics as normal.

In short what we have is another example of the fact that apparently simple statistics can be very misleading in something as complicated as economics.

Help

Help