401K or bust... he who does not learn from the past is doomed to repeat it

#1

Posted 2013-December-29, 14:42

#3

Posted 2013-December-30, 14:24

#4

Posted 2014-January-08, 06:58

#6

Posted 2014-January-08, 20:42

32519, on 2014-January-08, 06:58, said:

32519, on 2014-January-08, 06:58, said:

all defaults are not equal, even if the usa defaults it can rise again. the usa is the country of second chances after failure.

with that said, many will be hurt..yes. the most important point you make is even in 2014 the world is full of pain.

#7

Posted 2014-January-09, 01:08

mike777, on 2014-January-08, 20:42, said:

mike777, on 2014-January-08, 20:42, said:

jjbrr, on 2014-January-08, 12:50, said:

jjbrr, on 2014-January-08, 12:50, said:

Read this article on the National Debt of the United States. Here are some quotes from the article –

Quote 1: “In recent decades, however, large budget deficits and the resulting increases in debt have led to concern about the long-term sustainability of the federal government's fiscal policies.”

Quote 2: “On December 12, 2013, debt held by the public was approximately $12.312 trillion or about 73% of Q3 2013 GDP. Intragovernmental holdings stood at $4.9 trillion (29%), giving a combined total public debt of $17.226 trillion or over 100% GDP. As of January 2013, $5 trillion or approximately 47% of the debt held by the public was owned by foreign investors, the largest of which were the People's Republic of China and Japan at just over $1.1 trillion each.”

With $12.312 trillion of the national debt held by the public, imagine the carnage when the USA defaults? This excludes the off-balance sheet obligations of Fannie Mae and Freddie Mac, another $5 trillion.

Quote 3: “Sustainability – According to the Government Accountability Office (GAO), the United States is on a fiscally unsustainable path because of projected future increases in Medicare and Social Security spending, and that politicians and the electorate have been unwilling to change this path. Further, the subprime mortgage crisis has significantly increased the financial burden on the U.S. government, with over $10 trillion in commitments or guarantees and $2.6 trillion in investments or expenditures as of May 2009, only some of which are included in the public debt computation.

Quote 4: “Interest costs – Despite rising debt levels, interest costs have remained at approximately 2008 levels (around $450 billion in total) due to lower interest rates paid to Treasury debt holders. However, should interest rates return to historical averages, the interest cost would increase dramatically. Historian Niall Ferguson described the risk that foreign investors would demand higher interest rates as the U.S. debt levels increase over time in a November 2009 interview.

How about the United States Debt Ceiling?

Quote 1: “A default could trigger a variety of economic problems including a financial crisis and a decline in output that would put the country into a recession.

Or this article United States Federal Budget.

Quote 1: During FY2013, the federal government collected approximately $2.77 trillion in tax revenue, up $326 billion or 13% versus FY2012 revenues of $2.45 trillion.

Quote 2: During FY 2013, the federal government spent $3.45 trillion on a budget or cash basis, down $84 billion or 2.4% vs. FY 2012 spending of $3.54 trillion.

With expenditure outpacing revenue your country has squat chance to reduce the national debt. Currently you are down slightly on interest payments because of the historically low interest rates. When public debt holders start demanding higher interest rates, your government is going to be placed under even more pressure than it already is.

As pointed out by others in all the above related links this cycle is unsustainable. At some point the bubble will burst and the carnage that will spread across the globe is just too awful to imagine. As they rightly say, "When the USA sneezes the world catches a cold."

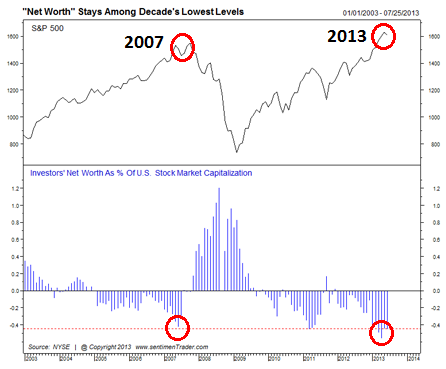

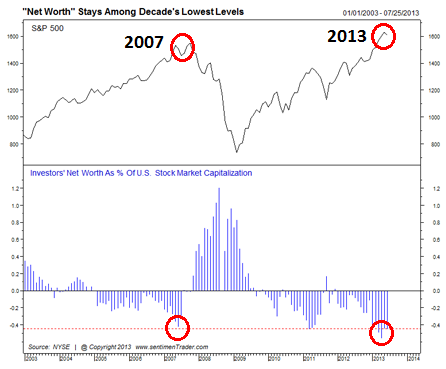

Ben Bernanke with his monetary policies, has set in motion a cycle of printing cheap money (which is finding its way into the stock market and continually driving prices up), which is going to end in carnage. Janet Yellen is succeeding Ben. Tragically for the Womens Liberation Movement or Equal Opportunity for Women or Women Empowerment Movement or whatever Women Emancipation Movement you care to name, she will be blamed for the carnage created by Ben.

#8

Posted 2014-January-09, 13:06

32519, on 2014-January-09, 01:08, said:

32519, on 2014-January-09, 01:08, said:

Somehow the above transcends "ordinary" sexism and suggests a worldview that is truly fu cked up. Oh wait...

#10

Posted 2014-January-09, 14:46

In the words of Bob Newhart, Stop It! The National Debt is actually essential to our economy. If the National Debt were eliminated, the economy would probably collapse.

There are actually limits on how much of the National Debt can be paid off. As a practical matter, those limits are not relevant, as we are in no danger of paying off the National Debt. But there have been times when the US ran a surplus (as recently as the Clinton Administration) and the National Debt was reduced.

#11

Posted 2014-January-09, 15:34

ArtK78, on 2014-January-09, 14:46, said:

ArtK78, on 2014-January-09, 14:46, said:

I do not believe this for one minute. Can you prove it?

As for tv, screw it. You aren't missing anything. -- Ken Berg

Our ultimate goal on defense is to know by trick two or three everyone's hand at the table. -- Mike777

I have come to realise it is futile to expect or hope a regular club game will be run in accordance with the laws. -- Jillybean

#12

Posted 2014-January-09, 16:09

blackshoe, on 2014-January-09, 15:34, said:

blackshoe, on 2014-January-09, 15:34, said:

No, as there has never been a time in modern history that the National Debt has been close to zero.

But it really doesn't matter what you (or, for that matter, what I) believe about that hypothetical situation. The main point is that the debt as it exists and as it will exist in the future (no doubt at still higher levels) is not a serious problem.

I do know that when there were serious attempts to pay down the debt (or to not borrow because it would increase the debt) the economy suffered.And that is a contrast between trying to equate individual behavior and government behavior. For an individual, it is often (but not always) beneficial to pay down debt. For a government, it is often (but not always) harmful to pay down debt.

Perhaps someone could write a story along the lines of Dr. Strangelove except use the National Debt as the bogeyman instead of the atomic bomb - "How I Learned to Stop Worrying and Love the National Debt."

#13

Posted 2014-January-09, 16:15

#14

Posted 2014-January-09, 16:19

blackshoe, on 2014-January-09, 15:34, said:

blackshoe, on 2014-January-09, 15:34, said:

Prove it? No. With this said and done, there are pretty well accepted theories that its good to run up debt during economic contractions and good to pay down debt during economic expansions.

The only time I recall seeing arguments that it is dangerous to pay down the debt were during the early years of W's first term.

W's economic team argued that it was dangerous to run budget surpluses and pay down the debt as a justification for large tax breaks for the wealthy.

(From what I can tell, the entirety of Republican economic policy is large tax breaks for the wealthy. It doesn't matter if you're running a surplus or a deficit, experiencing an expansion or a contraction, the solution is always the same)

#15

Posted 2014-January-09, 16:54

blackshoe, on 2014-January-09, 15:34, said:

blackshoe, on 2014-January-09, 15:34, said:

As long as the returns on the investments by the government are higher than the interest rates, it pays to borrow.

This will generally be the case when you have zero debt, which shows that having some debt is better than having no debt.

Rik

The most exciting phrase to hear in science, the one that heralds the new discoveries, is not “Eureka!” (I found it!), but “That’s funny…” – Isaac Asimov

The only reason God did not put "Thou shalt mind thine own business" in the Ten Commandments was that He thought that it was too obvious to need stating. - Kenberg

#16

Posted 2014-January-09, 17:04

I can't but imagine that the post of the year is soon to be revealed.

If only the Romney campaign were still paying Lukewarm to post, we'd hit the stupidity trifecta.

#17

Posted 2014-January-09, 18:35

#18

Posted 2014-January-09, 18:55

ArtK78, on 2014-January-09, 14:46, said:

ArtK78, on 2014-January-09, 14:46, said:

In the words of Bob Newhart, Stop It! The National Debt is actually essential to our economy. If the National Debt were eliminated, the economy would probably collapse.

There are actually limits on how much of the National Debt can be paid off. As a practical matter, those limits are not relevant, as we are in no danger of paying off the National Debt. But there have been times when the US ran a surplus (as recently as the Clinton Administration) and the National Debt was reduced.

If my weight were eliminated, i would probably collapse. It would be unwise to lean on this undeniable fact as an excuse for doing nothing about my excess weight.

I am thinking our problem is more our overall commitments rather than specifically our debt. But debt is a committment, so debt is part of the problem.

#19

Posted 2014-January-10, 00:16

kenberg, on 2014-January-09, 18:55, said:

kenberg, on 2014-January-09, 18:55, said:

Precisely. I'm not an economist, but "the debt is not a serious problem" is IMO wrong, and if it's right, there must be some economic theory to back that statement up. So, Art, what is that theory? Where can I study it?

As for tv, screw it. You aren't missing anything. -- Ken Berg

Our ultimate goal on defense is to know by trick two or three everyone's hand at the table. -- Mike777

I have come to realise it is futile to expect or hope a regular club game will be run in accordance with the laws. -- Jillybean

#20

Posted 2014-January-10, 00:37

ArtK78, on 2014-January-09, 16:09, said:

ArtK78, on 2014-January-09, 16:09, said:

1835 was the only time the US had a zero national debt. Shortly after that the country went into the longest depression in the nation's history.

Planet Money discussed this in 2011.

Help

Help